Sage One

Guide for Sage One Accounting and Sage One Payroll

What is Sage One?

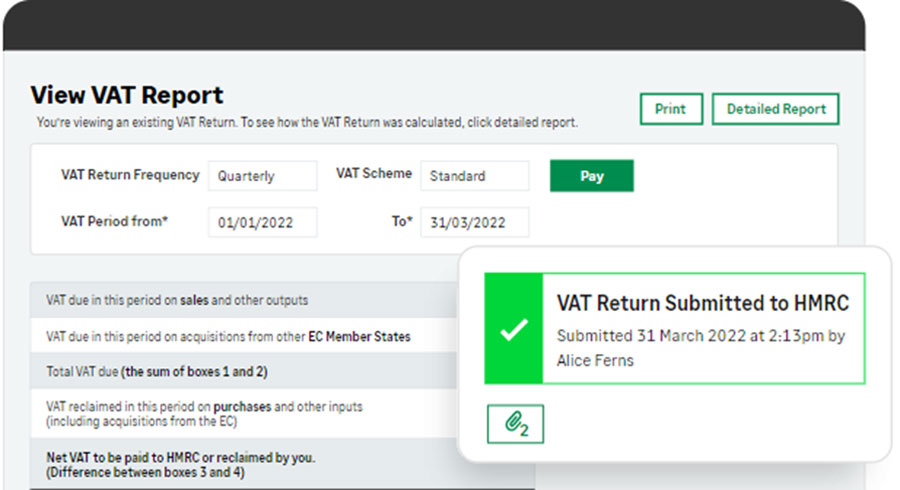

Sage One is an online accounting and payroll solution for small business owners and sole traders in the UK. Sage One (now known as Sage Accounting) manages accounting, invoicing, cash flow, bank reconciliation, snap receipts, expenses, payroll, payslips and compliance, it is also MTD compliant and enables you to submit VAT returns online to HMRC.

The Sage One solution is easy to use and intuitive and is hosted online in the Cloud by Sage, so you do not need to install the software onto your own computer. New software updates are automatically applied to Sage One by Sage, so you are always using the latest version.

Key Software Features

- Create and send sales invoices

- Track what you’re owed

- Automatic bank reconciliation

- Be Making Tax Digital Ready for VAT and HMRC

- Calculate and submit VAT online

- Forecast cash flow

- Manage purchase invoices

- Record expenses and snap receipts with AutoEntry

- Manage inventory

- Manage and submit CIS

- Pay staff and manage Payroll

- Send quotes and estimates

- Unlimited users (with the Accounting Plus version)

Guides

Sage One – What is it and what is it Used For?

Call us today on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss the range of Sage Business Cloud Accounting products, from Sage One, Payroll, Sage 50, Sage 200 and Sage Intacct

What is Sage One now called?

Sage One and Sage One Payroll are now called Sage Accounting and Sage Payroll and is part of the Sage Business Cloud product range, the name change occurred in 2018 with a release of a new version and updated user interface.

Sage One users can log into the system at Sageone.com which then redirects you to the new Sage Accounting login screen for your country.

Why Use Sage One?

- See your current financial position at any time

- Everything is in one place

- Work from anywhere with Internet connection

- Great value for money and you can spread the cost by paying monthly

- Frees up IT resources and reduces expensive IT overheads

- The solution requires nothing to install and is constantly updated by automatically applying software updates

- Real time financial data is available 24/7

- Manage payroll and employee payslips

- Sage One Cloud security is world class and is hosted at one of many Datacentres where you have protection against financial and accounts data loss

- No need to invest in expensive servers or data backup hardware

- Easily collaborate with your accountant and other Sage One users in your business

- Easily submit VAT returns online and is making tax digital compliant (MTD)

What is Sage One Used For?

Sage One online looks after your business accounts, finances, payroll, tax commitments and submitting VAT online to HMRC, Sage One is also used by sole traders and the self-employed for self-assessment Tax returns.

The Sage One accounting software helps your business in the following areas:

- Smarter invoicing – Get paid on time and protect your cash flow with personalised invoices that you can track.

- Track taxes – HMRC recognised software for Making Tax Digital helps you manage your tax and compliance, and submit VAT returns.

- Save and snap receipts – Pull in data and documents including receipts automatically with live bank feeds and AutoEntry.

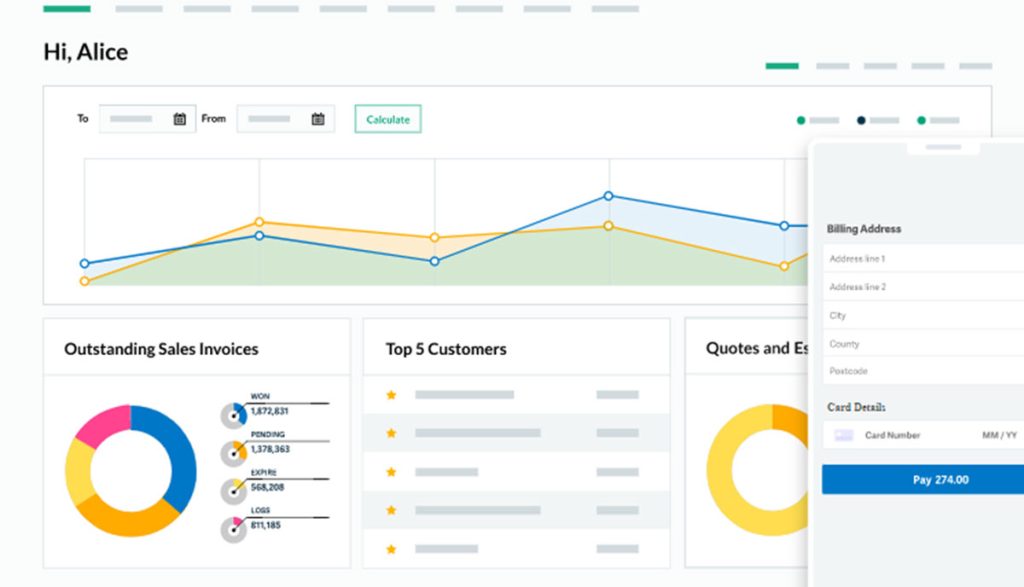

- Control your cashflow – See how much money is coming in and out of your business each month, on an insightful dashboard.

- Pay your people – Run your next payroll securely, accurately and compliantly.

- Share access easily – Collaborate securely with your accountant in real-time. Let your team spot and fix mistakes. Works on any device.

Sage One (Sage Accounting) Detailed Features

The Sage One core features enable you to create and send invoices, automatic bank reconciliation, track what you are owed, and calculate and submit VAT online to HMRC.

There are three different versions of Sage One (Sage Accounting) to choose from, Start, Standard and Plus, all three versions contain the same core features, additional add on’s include Sage Payroll and AutoEntry.

Features for Sage Accounting Start (previously Sage One start)

- One user only

- Create and send sales invoices

- Track what you’re owed

- Automatic bank reconciliation

- Be Making Tax Digital Ready for VAT

- Calculate and submit VAT

- Basic online dashboards

- Add Sage Payroll as an additional module

Sage Business Cloud Accounting Start - Bank reconciliation

Sage Accounting Standard Features (previously Sage One Standard)

Ideal for sole traders, freelancers and start-ups, all the features of Start but more functionality including better reporting.

- Making Tax Digital Ready for VAT

- Create and send invoices

- Track what you’re owed

- Automatic bank reconciliation

- Calculate and submit VAT

- Supports unlimited users

- Manage and submit CIS

- Run advanced reports

- Send quotes and estimates

- Forecast cash flow

- Manage purchase invoices

- Snap receipts with AutoEntry

- Add Sage Payroll as an additional module

The Payroll and AutoEntry add-ons are extra, prices do change so check for the latest deals and prices from the Sage accounting page, further information.

Introduction of Sage Accounting Start

Sage Accounting Plus Features (previously Sage One Plus)

All the features of Start and Standard, with better stock management and multi-currency banking.

- Multi-currency banking and invoicing

- Manage inventory

- Manage and submit CIS

- Run advanced reports

- Send quotes and estimates

- Forecast cash flow

- Manage purchase invoices

- Snap receipts with AutoEntry

- Create and send invoices

- Track what you’re owed

- Automatic bank reconciliation

- Be Making Tax Digital Ready for VAT

- Calculate and submit VAT

- Unlimited users

- Add Sage Payroll to the subscription

Sage One Payroll Features

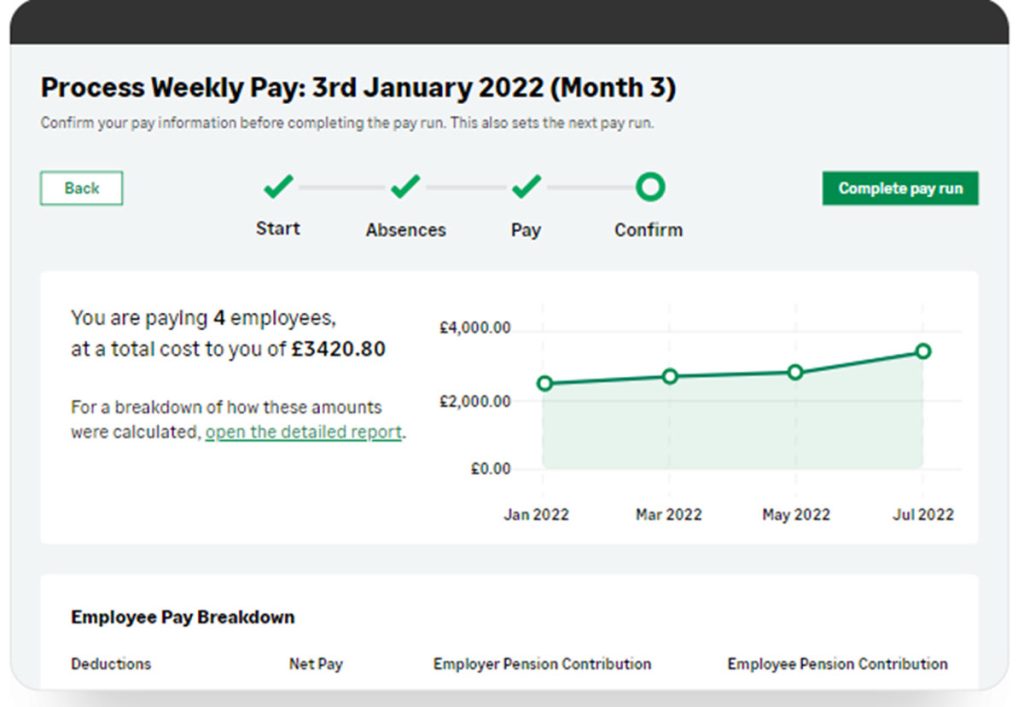

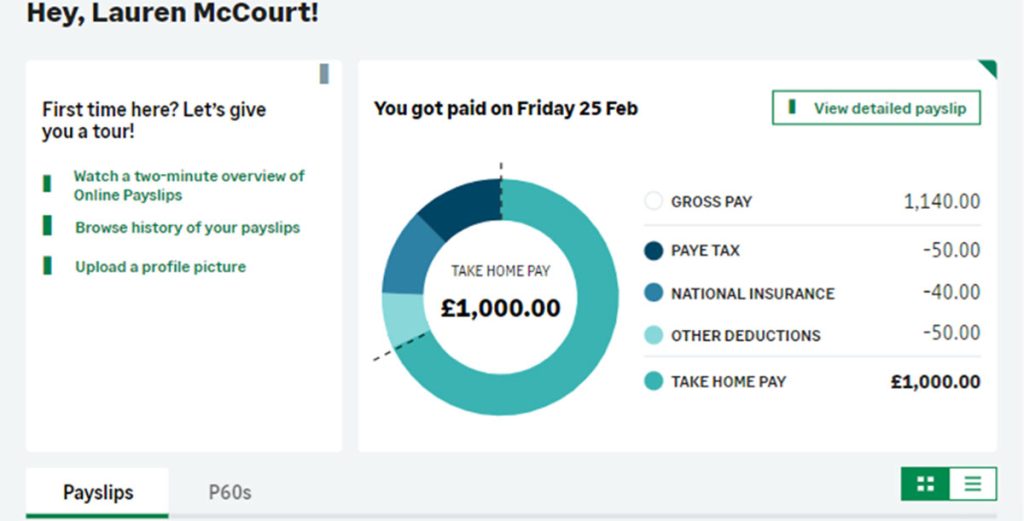

The Sage One payroll software (now known as Sage Payroll) enables you to run your next payroll securely, accurately and compliantly. Learn more about payroll.

- Manage payroll for up to 100 employees

- Complete a pay run in 4 simple steps

- Avoid mistakes with fully HMRC compliant solution

- Enable employees self-serve payslips and P60s in-app

- Report on and analyse your payroll to make informed decisions

- Get expert support 24/7, all year round

- Automatically assess and enrol employees into workplace pensions

- Collaborate in real-time with your accountant

- Easily switch to Sage with a simple setup and data import

- Automatically track your payroll data in Sage Accounting

Frequently Asked Questions

Sage 50 has more advanced features and is more flexible and ideally suited for small to medium sized businesses, whilst Sage One (now Sage accounting) offers easy to use basic accounting features for small business owners and sole traders. Read our guide Sage One vs Sage 50.

Sage One (sage accounting) starts from £12 per month for Start, Standard is £26 per month, and Sage Accounting plus is £33 per month. The use of the licenses is based on a monthly subscription fee, which can be cancelled at any time.

Many Sage One users who have outgrown the software consider moving to other Sage accounting solutions such as Sage 50 Accounts, Sage Intacct and Sage 200 Standard.

To log into Sage One (now known as Sage Accounting) go to Sage.com and click on the “Login” button, then select Sage Accounting and enter in your email and password that is associated with your Sage One account. You can also login to Sage One on your mobile if your download the app.

Sage One is MTD compliant if you use the latest version (Sage Business Cloud Accounting). As Sage Accounting Start, Standard and Plus enables you to submit VAT online to HMRC, as it recognised as MTD compliant software.

Summary of the Benefits of Sage One (now known as Sage Accounting)

- Sage One is Very Intuitive and Easy to Use –There are no courses needed to be completed the software has a very useful help feature if you ever get stuck.

- Accessible 24/7– Because Sage One runs in the Cloud you can access your accounts data anytime from anywhere 24/7, all you need is internet access.

- Flexible and Affordable Pricing – With 3 different versions of Sage One (Sage Accounting) to choose from you can pay a low monthly subscription, and you can upgrade or cancel at any time.

- Secure –The system is hosted at their world class secure datacentres. Backups and updates are automated, so your finance system is always up to date and compliant with the latest legislation for VAT and GDPR.

- Manage Payroll – Add Sage Payroll to the software to manage payroll, payslips and TAX to HMRC.

- Mobile Compatible –Access on mobile devices to check your accounts on dedicated mobile apps for iOS and Android.

- Collaborative –Easily share information with team members or give access to your accountant.

- Scalable –Add more users by upgrading to the Plus version which gives you more features and users.

Strengths and Advantages for Sage One

- Easy to use and intuitive

- Offers simple cloud accounting core functionality

- Good value

- Easy to learn with the minimum amount of training needed

- Ideal for small business owners, sole traders and the self employed

Weaknesses and Disadvantages for Sage One

- Lacks advanced accounting features

- Not very flexibly and customisable

- Cannot automate complex accounting processes

- Does not work well in larger SMB companies or medium sized businesses

- Does not adapt well for fast growing businesses who need an accounting system that adapts as they grow

Why choose AlphaLogix as your Sage Business Partner

AlphaLogix was founded in 1995 and today we are a leading tier 1 strategic Sage Business partner in the UK. Our Sage consultants have successfully implemented hundreds of Sage sites across the UK and we understand the need for a well-planned and smooth implementation process.

What do our Customers Say?

Call us today on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss the range of Sage Accounting and Finance products, from Sage One, Accounting, Payroll, Sage 50, Sage 200 and Sage Intacct, we can help you decide which product is best suited for your companies accounting and finance requirements.

Our Professional Services Include:

- Implementation and Installation

- Sage consultancy

- Integration with other business systems

- Report designing

- Fixing databases

- Upgrades and Migrating data from your existing Sage accounting system

- Sage Training

- Help desk support

- Ecommerce integration, such as Websites, Amazon, Shopify, Woo Commerce

- Managed IT Support and Services

Related Searches