Sage 200 Tips – Help is never far away

22nd June 2016V18.1 – What is new in Act!?

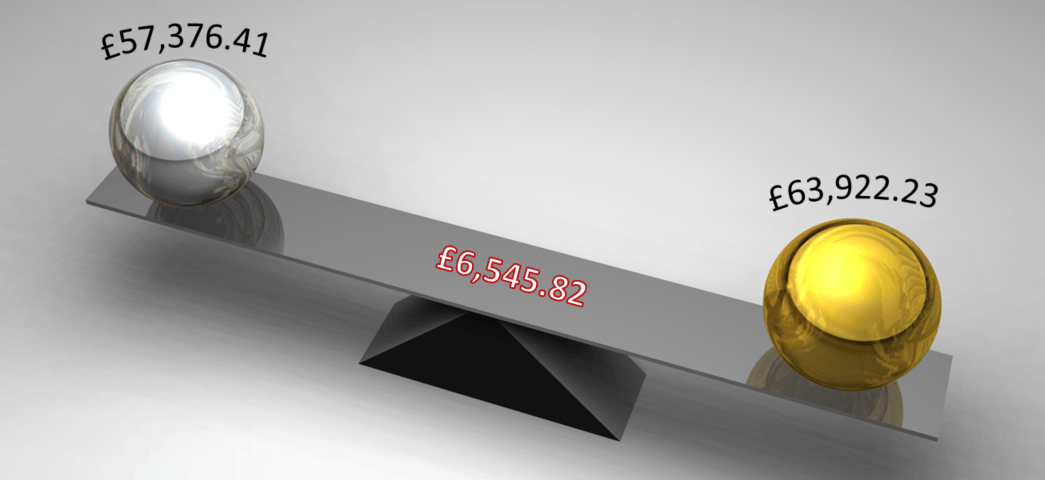

8th July 2016One of the most frustrating issues that an Accountant can experience with their Accounting system is an unexpected imbalance. With that said, one of the most common imbalances in Sage 200 can occur between the Debtors/Creditors Aged Debt report and the Sales/Purchase Ledger Control Account(s). In this blog I’ll explore one of the tools that Sage 200 provides to help you reconcile the two balances.

There are many reasons as to why variances can arise between the Sales/Purchase Ledger and the Nominal Ledger:-

- Transactions not yet posted to the Nominal Ledger.

- Transactions posted to the suspense account.

- Transactions posted to different periods.

- Currency adjustments.

- Transactions that are posted to one ledger and not the other.

- Previous imbalance.

One of the great tools available for investigating an imbalance is called the Reconciliation Enquiry. There’s one of these for Debtors and also one for Creditors, but in the following example I’ll be using the Debtor Reconciliation Enquiry.

Debtor Reconciliation Enquiry

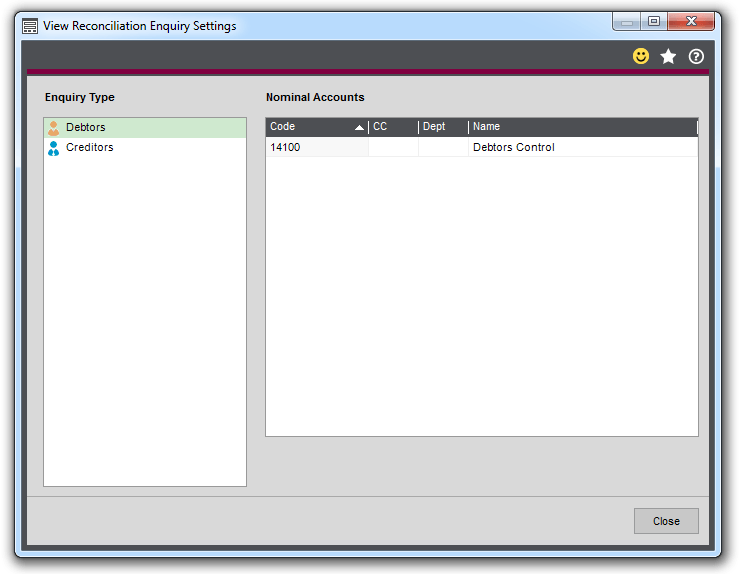

The Debtor Reconciliation Enquiry can be used to reconcile your Sales Ledger accounts with the Nominal Ledger and will highlight discrepancies between the two. Before you use the Enquiry you must first define your Nominal Control Account(s).

From the Nominal Ledger, select Utilities > Ledger Set Up > Reconciliation Enquiry Settings. Use the Nominal Accounts drop-down list to select the Nominal Control Account(s)…

Having added the Debtors Nominal Control Account(s), select Save and Close.

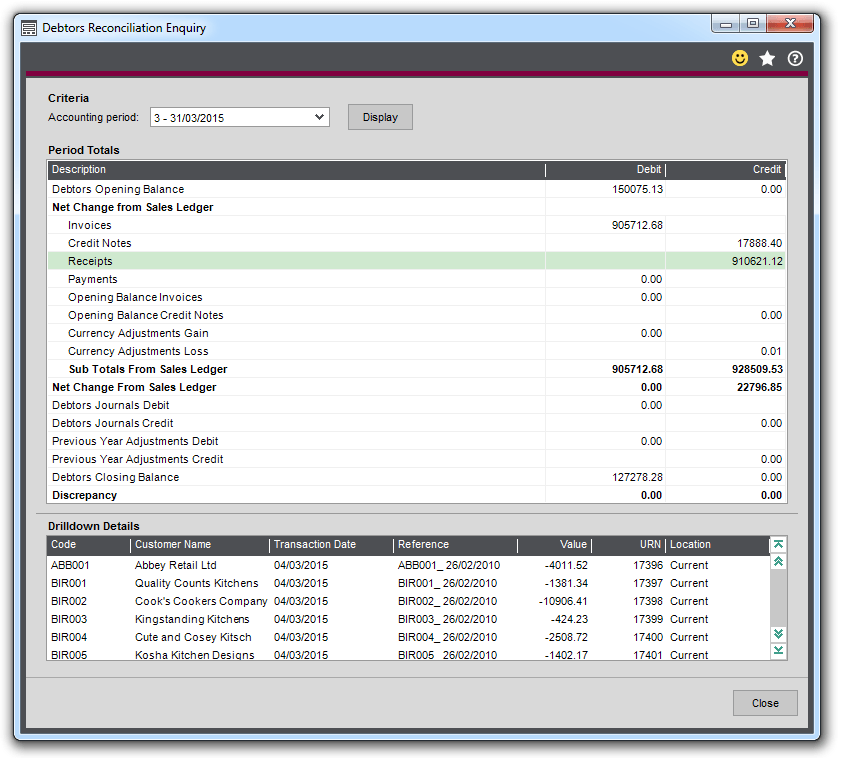

From the Sales Ledger, navigate to Sales Enquiries > Debtors Reconciliation Enquiry and select the Accounting Period that you’re investigating and select Display.

This enquiry will display the following for the period that you’ve selected:-

- The opening balance of your Debtors Control Nominal Account(s).

- Totals of any transactions posted to the Debtors Control Accounts from the Sales Ledger.

- Totals of any currency gains or losses posted to the Nominal Ledger.

- Totals of any Journals posted directly to the Debtor Control Account(s).

- The closing balance of your Debtors Control Nominal Account(s).

- Any discrepancy in the opening balance and closing balance of the Debtors Control Nominal Account(s) that didn’t arise from the Sales Ledger.

Please be aware that if this enquiry doesn’t highlight any discrepancies, this doesn’t necessarily mean that the Aged Debt reports and Debtors Control Account(s) will match, but it’s a good start!

Keep an eye out for future blogs from the team at AlphaLogix!

Our team of Accredited Sage 200 Product Specialists have many years of experience and are here to help, from initial consultation through to: development, implementation, training and on-going support.

If you would like any further information or a demonstration of Sage 200, please contact us:

Email: info@AlphaLogix.co.uk

Tel: 0845 259 3141

Kind Regards,

Richard Owens | Product Specialist